As the largest city in Minnesota, Minneapolis has a thriving economy, a bustling arts scene, and a growing tourism industry. For homeowners looking to capitalize on this, the short-term rental market can be an attractive option.

In this guide, we’ll take a closer look at the short-term (Airbnb) rental market in Minneapolis, including occupancy rates, revenue potential, and regulations.

Market Overview

To understand the dynamics of the short-term rental market in Minneapolis, let’s delve into some key statistics and figures.

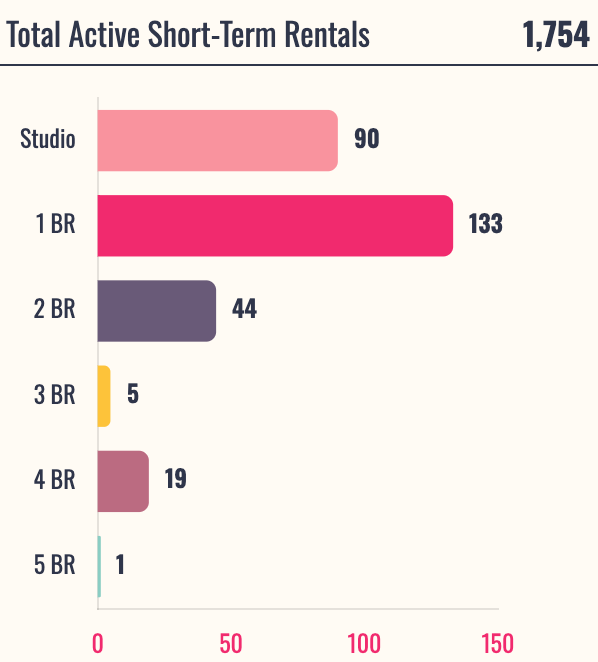

Supply

The most popular homes are 1-bedroom homes, comprising 46.82% of inventory. This is followed by Studio and 2-bedroom homes at 31.36% and Studio 13.64% of the total inventory, respectively.

Homes Appreciation

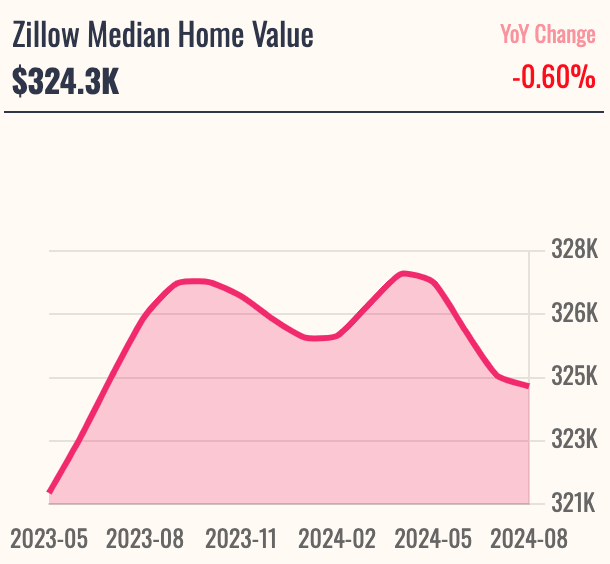

As of October 2024, according to Zillow, homes in Minneapolis experienced an appreciation of -0.60%. This data indicates a significant increase in property values.

As of October of 2024, Homes in Minneapolis have appreciated by –0.60%. The median home value in Minneapolis is $324,300 as reported by Zillow. This figure highlights the city’s robust real estate market and the potential for long-term property appreciation.

Active Short Term Rentals

As of October 2024, Minneapolis boasts a significant Airbnb rental market, with approximately 1,754 active rentals. This abundance of available properties provides ample opportunities for investors and homeowners looking to capitalize on the tourism demand.

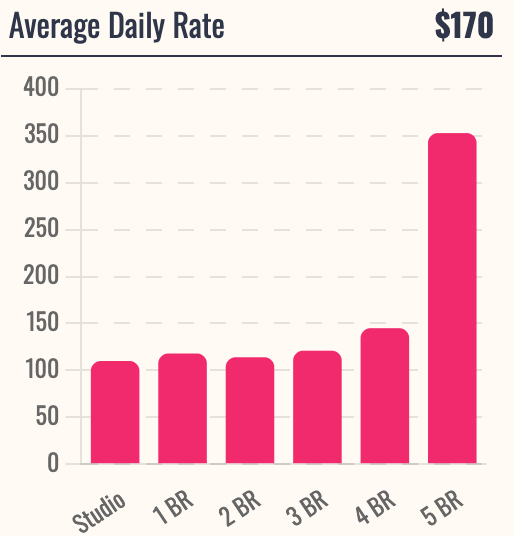

Average Daily Rate

The median ADR for the market is $170. The Average Daily Rate is the highest for 5 bedroom homes ($353) followed by 4-bedrooms and 3 bedrooms at $145 and $121 respectively.

Occupancy Rate

Chalet data reveals an occupancy rate of 61% for Airbnb rentals in Minneapolis. This high demand ensures a consistent stream of income for property owners and investors.

How Profitable is Airbnb in Minneapolis ?

As of October 2024, the average gross yield, which represents the annual income generated by a property as a percentage of its value, is 6.59% in Minneapolis. This figure suggests that short-term rentals in the city offer a favorable return on investment. Minneapolis is ranked #60 by return on investment on Airbnb rentals in the United States.

Annual Revenue

According to Chalet, short-term rentals in Minneapolis earn an average of $21,383 annually, highlighting the strong investment potential in the city’s market. You can evaluate your properties using our free Airbnb calculator.

Property Tax

According to SmartAsset, the average property tax in Minneapolis is 1.23%. This relatively moderate tax rate is an important consideration for those looking to invest in short-term rental properties.

Regulations

Minneapolis’s short-term rental regulations are somewhat investor-friendly, with different zoning regulations and limitations in place. Understanding these regulations is crucial for potential investors to ensure compliance and a smooth operation.

Top Places for Airbnb in Minneapolis

Minneapolis top submarkets for Airbnb investments include areas like ZIP code 55432, which has the highest gross yield at 19% and an annual revenue of $57,872. In contrast, ZIP code 92109 offers more extensive opportunities with 150 full-time listings, but a lower gross yield of 11%.

Home values also vary significantly, with properties ranging from $141.7K in 67467 to $367K in 55443, making each submarket unique in terms of investment potential and entry cost.

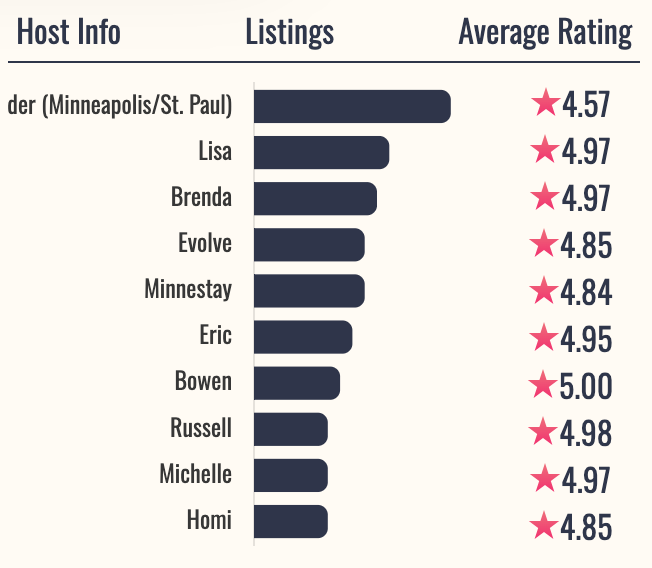

Hosts

The market is dominated by property management firms. The largest host is Der (Minneapolis/St.Paul) with 4.57% of the total inventory and an average review of 4.58⭐️s .

Population

Minneapolis is the largest city in Minnesota, with a population of over 425,000 people. The city is known for its thriving arts scene, diverse communities, and thriving economy. In recent years, Minneapolis has also become a popular tourist destination, with a growing number of visitors each year.

Top 200 Airbnb Rental Markets

Instantly compare top 200 short-term (Airbnb) rental markets in the US

Sports Teams

Minneapolis is home to several professional sports teams, including the Minnesota Vikings (football), the Minnesota Twins (baseball), and the Minnesota Timberwolves (basketball). These teams have a strong following among local residents and visitors alike, and attending a game can be a fun and exciting way to experience the city’s sports culture.

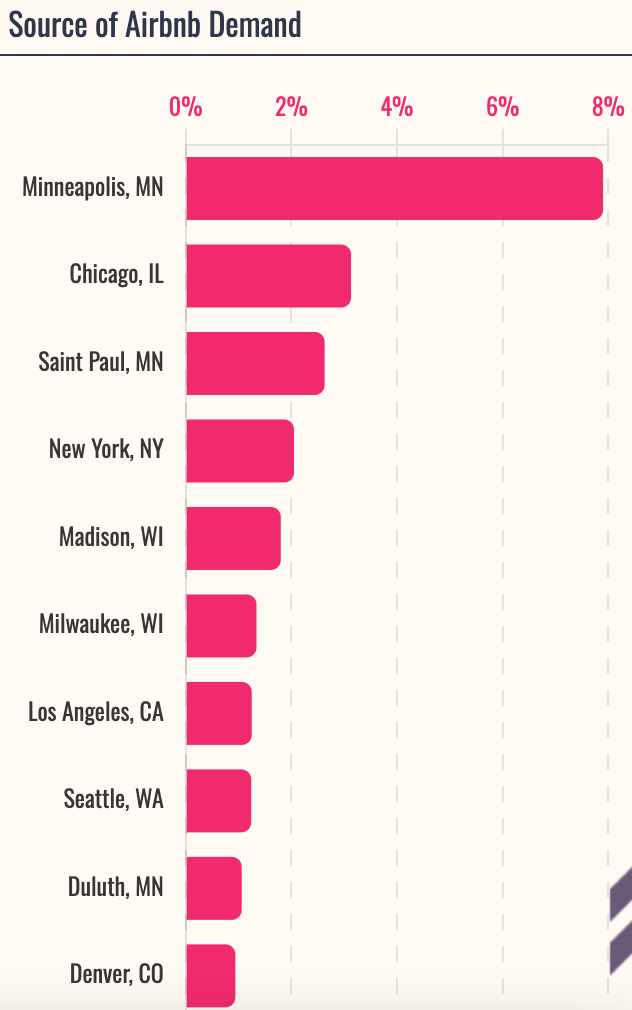

Guests

The majority of the guests come from inside of Minnesota. 8.00% of all guests are from Minneapolis followed by Chicago with 3.01%.

Colleges

Minneapolis is also home to several notable colleges and universities, including the University of Minnesota, Augsburg University, and North Central University. These institutions are known for their academic excellence and contribute to the city’s vibrant intellectual and cultural communities.

Crime Rate

Like many cities, Minneapolis has a crime rate that is higher than the national average. According to recent statistics, the city has a crime rate of 58 per 1,000 residents. However, it’s important to note that crime rates can vary widely depending on the specific neighborhood and location within the city.

Tourism Industry

Minneapolis has a thriving tourism industry, with visitors coming from all over the world to experience the city’s unique culture and attractions. In 2019, the city welcomed over 33 million visitors, with many of them coming from nearby states like Wisconsin, Iowa, and Illinois.

Tourist Attractions

Minneapolis has several popular tourist attractions that draw visitors from near and far. Some of the most notable include the Mall of America, the Walker Art Center, the Minneapolis Sculpture Garden, and the Chain of Lakes. These attractions offer a wide range of experiences, from shopping and dining to art and nature.

Peak Season

The peak season for tourism in Minneapolis typically falls between May and September, when the weather is warm, and many outdoor events and festivals take place. However, the city is also popular during the winter months, thanks to its many indoor attractions and winter sports activities.

Conclusion

Conclusion In summary, Minneapolis has a thriving short-term rental market with consistent demand and strong revenue potential. However, investors should carefully consider the property tax rates, short-term rental regulations, home values, and appreciation rates before deciding. With the right approach, short-term rentals can be a profitable investment in this growing city.