(Gross Yields from 7.41%, $195 Average Daily Rate)

Quick Facts

Population – City – 1,307,402 (2020), Metro – 3,095,313 according to US Census Bureau

- MacroTrends states that San Diego is currently growing at a rate of 0.7% annually since 2021. As a benchmark, FreddieMac states that US cities grow at an average 0.3%.

- Famous for its sunny weather and impressive beaches

Cost of Living: Payscale ranks the cost of living in San Diego to be 44% higher than the national average. San Diego also has 136% higher housing expenses than the national average.

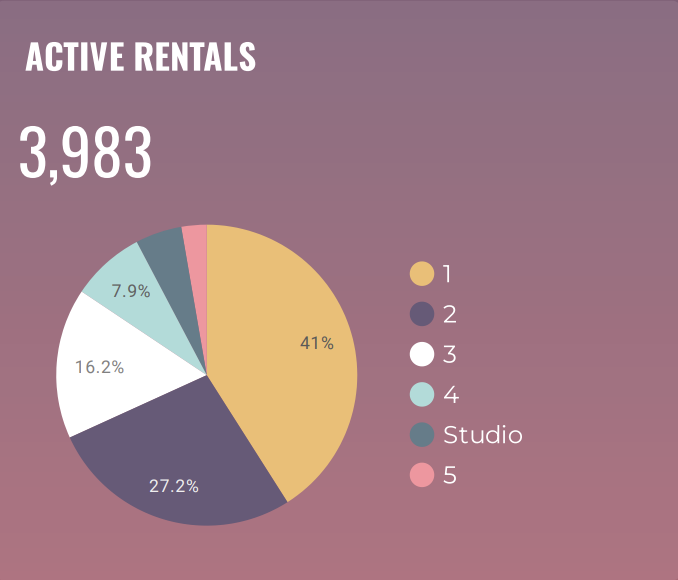

Active Rentals

There are 3983 active rentals in San Diego. Almost 68% of all listings are 1 and 2 bedrooms. Larger homes catering to bigger parties and families are potentially undersupplied. There are only 539 active 4 & 5 bedroom homes.

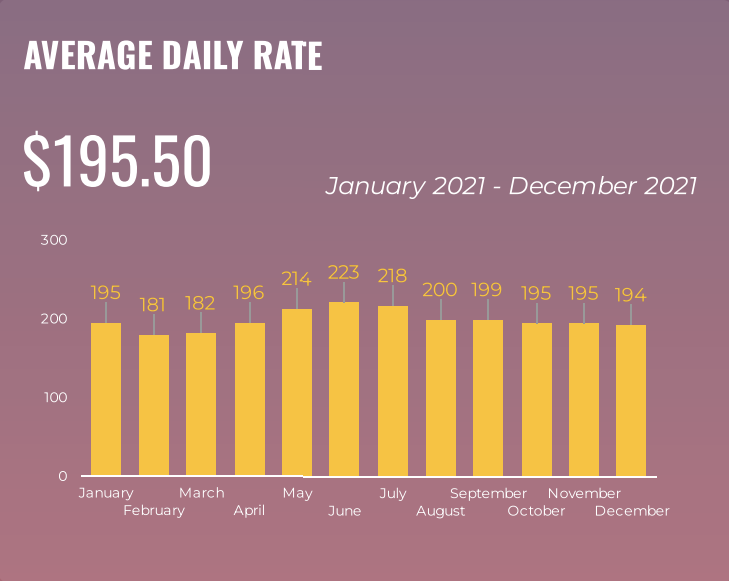

Average Daily Rate (Nightly Price)

The Average Daily Rate for rentals in San Diego is $199 dollars. Throughout the year, the rate fluctuates $24 from that average with the highest Average Daily in June ($223) and the lowest in February ($181).

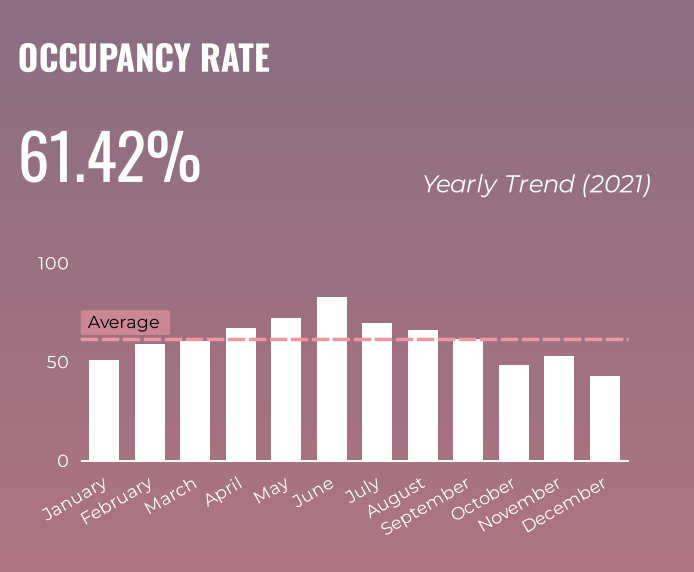

Occupancy Rate

Occupancy Rates in San Diego, California are the highest in the summer. The Occupancy Rate at an annual level is 61%. The lowest occupancy rate was in December (43%) and the highest was in June (83%). Drop-in occupancy rates in January and December of 2021 can be partially explained by a surge in COVID cases.

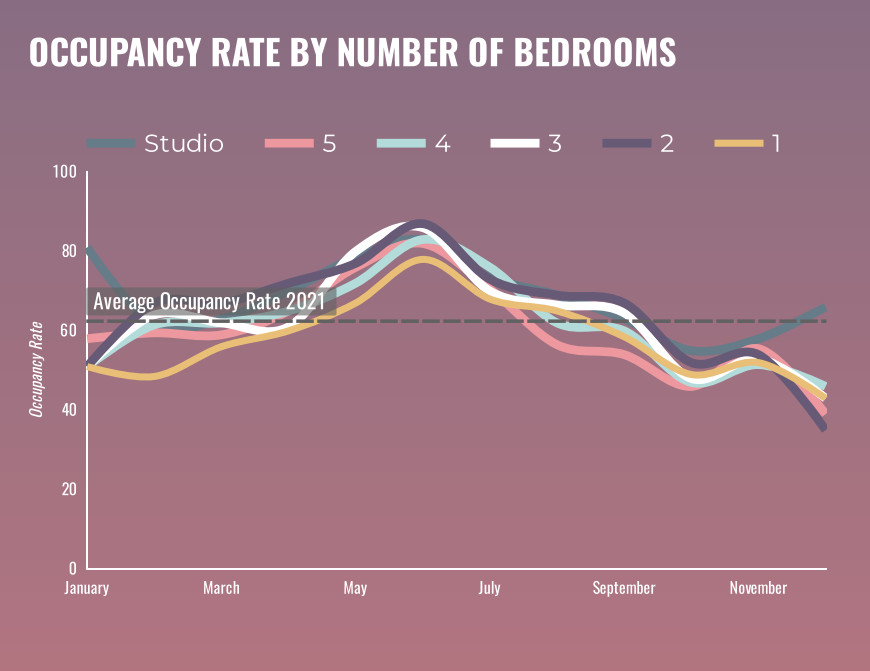

Occupancy Rate-Per-Bedroom

The average occupancy rate is the highest for Studios and 2 bedroom homes, 68% and 64% respectively.

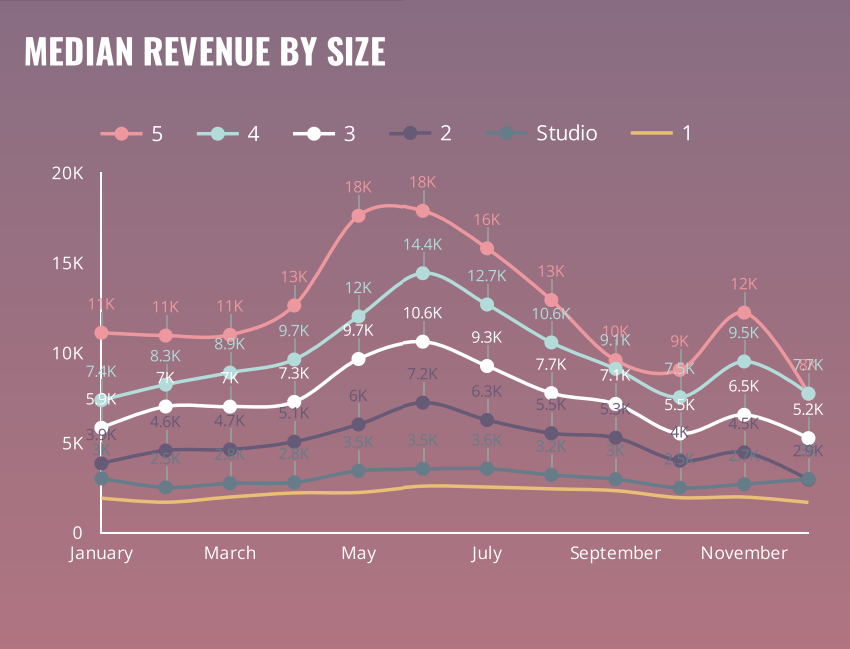

Monthly Revenue

The median revenue is the highest in June $5010 and the lowest in December $2570. Throughout the year, monthly revenue fluctuates the most for 5 bedroom homes and the least for 1 bedroom homes. More conservative investors should look into 1 bedroom investment properties as data shows they are the most stable and predictable.

More risk-tolerant investors should consider investing in Studios. Inventory is low for studio homes yet they consistently make more revenue. There is an opportunity to analyze the small number of studios’ properties and beat the competition.

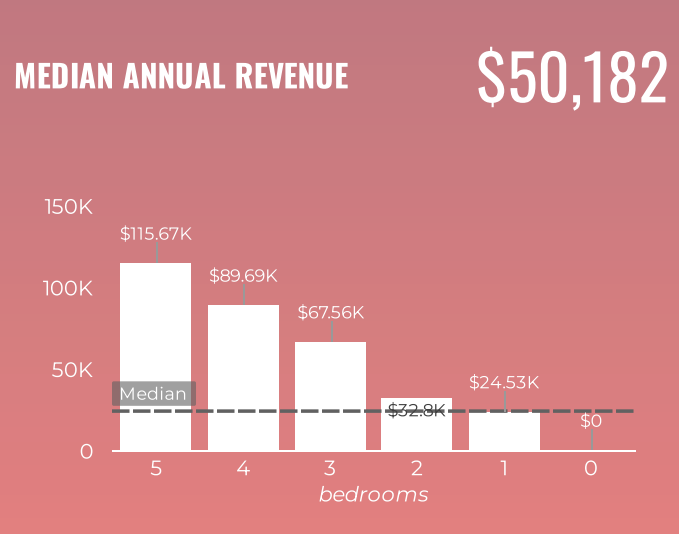

Annual Revenue

Short-term rentals in San Diego generate a median revenue of $50.182 annually. The highest median revenue for rentals in San Diego is for 5 bedrooms at $115,670.

High-Performance Properties

Chalet’s research shows that 2 bedroom homes have the highest percentage of homes in high yield territory (0.68%) therefore could be a good strategy for this market. Studios do not have enough samples to be considered (no active listings).

Chalet considers properties with a gross yield greater than 15% as high yield properties. Gross yield equals Gross Income/Purchase Price

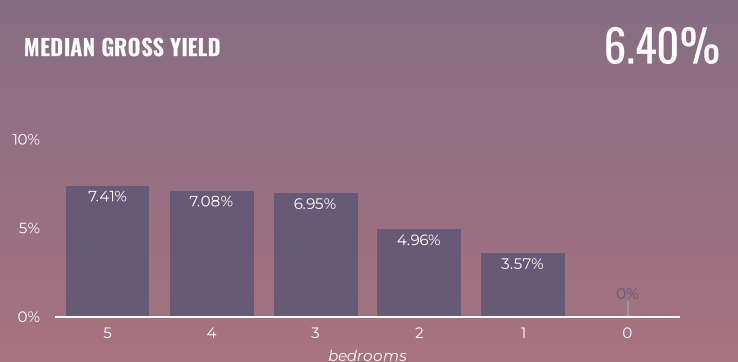

Median Gross Yield

The median gross yield for homes in San Diego is 6.40%. 5 bedrooms have the highest median gross yield (7.41%) followed by 4 bedrooms (7.08%) and 3 bedrooms (6.95%).

Supply

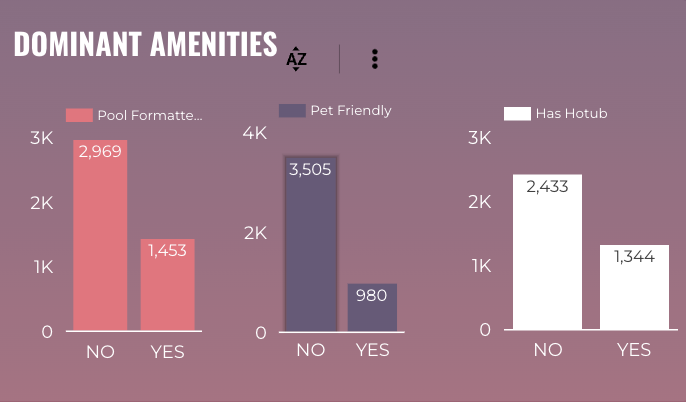

1453 active properties have a pool and 980 properties are pet-friendly. Chalet sees the potential opportunity for new investors to stand out by making their property pet-friendly. Surprisingly, 547 listings do not charge a cleaning fee. The average rating is 4.75, the largest host is Vacasa California, and the market is dominated by property management firms.

Demand

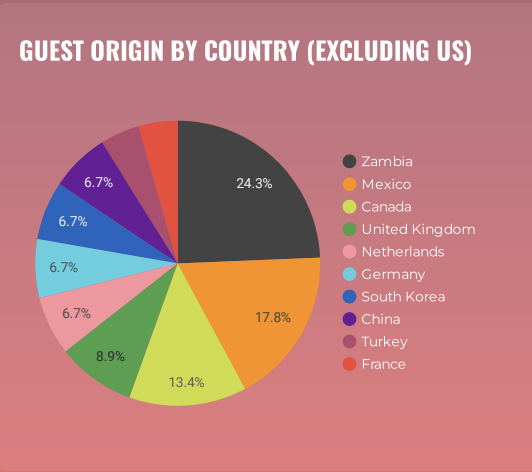

The majority of the San Diego short-term rental guests are domestic guests from the United States, though January is when the presence of international guests is most noticeable. However, international guests in February barely crossed the 1% threshold of total guests.

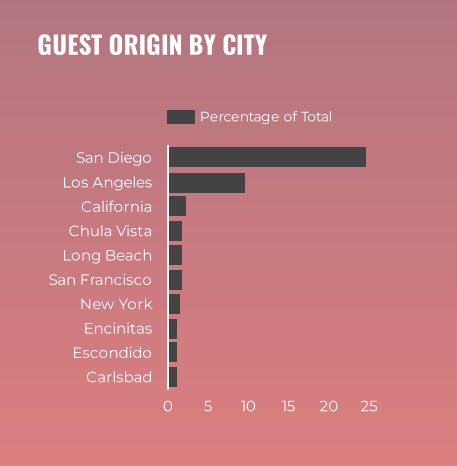

The majority of San Diego guests come from U.S. cities located within driving distance. Almost 25% of all guests in San Diego are from San Diego. We expect drive-to locations/cities to continue to do well in the post-covid world.

Other Facts

San Diego County has an effective property tax rate of 0.73%. That’s slightly lower than the 1.07% national average. Source: SmartAsset.

According to Zillow, homes in San Diego appreciated 26.2% year-over-year (YoY) and the median home price for active listings was $944,228 (as of March 2022).

Homes in San Diego average just 8 days on the market according to Redfin.

The BLS reported that the unemployment rate in San Diego County fell to 4.7% in January of 2022, which is higher than the national average of 3.8%.

Short-Term Rental Regulation

See Chalet’s detailed analysis of short-term rental regulation in San Diego county.

Ready To Start Your Investment Journey?

Data Methodology

For this guide, we analyzed everything from public data sources, recently sold homes, data from the Bureau of Labor and Statistics, Airbnb data, and more. Chalet ran this data through machine learning models to derive the forecast models with the most accurate predictions.

Glossary

- ADR: Average Daily Rate

- Gross Yield: Median Revenue/Median Home Price

- Price To Rent Ratio: The price-to-rent ratio is the ratio of home prices to annualized rent in a given location. This ratio is used as a benchmark for estimating whether it’s cheaper to rent or own property. The price-to-rent ratio is used as an indicator for whether housing markets are fairly valued, or in a bubble according to investopedia.

Thank you for reading. If you are interested in investing in San Diego, schedule a free consultation with one of our experts.