Introduction

Phoenix, Arizona, is a thriving market for short-term rental investments, thanks to its year-round warm weather, booming tourism, and growing population. Each ZIP code in Phoenix offers unique characteristics, promising varying levels of gross yield, annual revenue, and property values. Here’s a detailed look at some of the top-performing submarkets in Phoenix.

85023 – North Mountain Village

- Gross Yield: 10%

- Annual Revenue: $44,186

- Zillow Home Value: $430.5K

The 85023 ZIP code covers parts of the North Mountain Village area, known for its scenic hiking trails, outdoor recreational spaces, and suburban feel. With the highest gross yield on this list at 10% and a strong annual revenue of $44,186, this ZIP code is an attractive option for investors looking for high returns. The relatively moderate Zillow home value allows for a profitable investment, especially with steady demand from tourists and residents who appreciate the area’s natural beauty and easy access to urban amenities.

85053 – Deer Valley

- Gross Yield: 9%

- Annual Revenue: $35,002

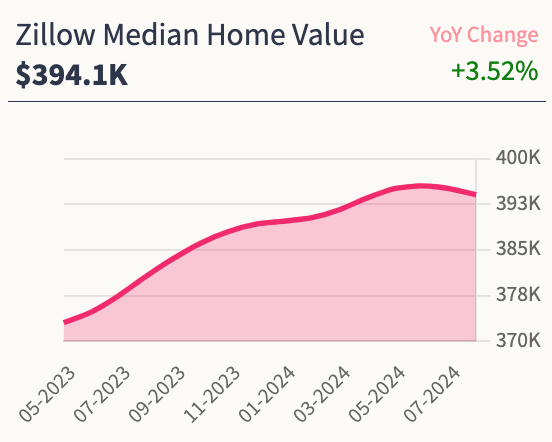

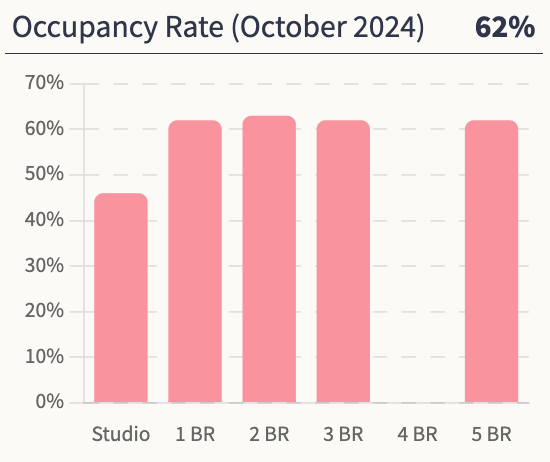

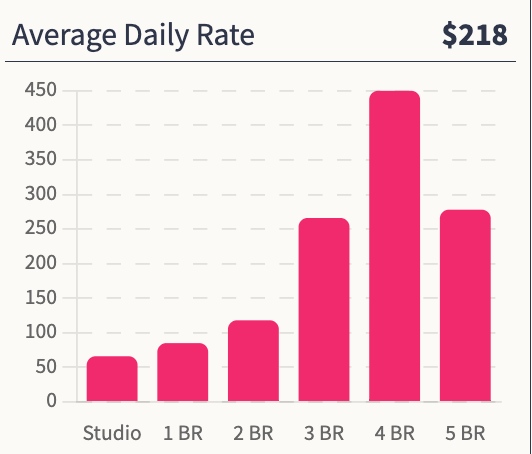

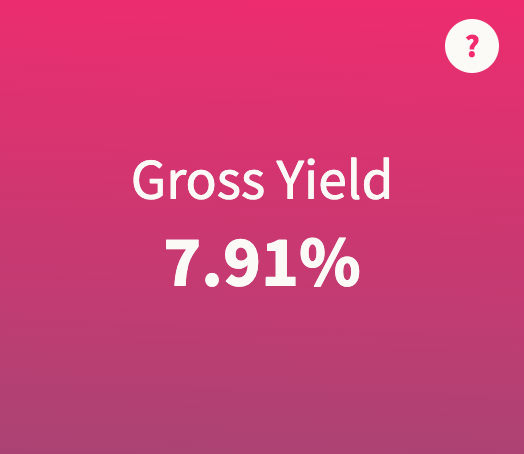

- Zillow Home Value: $394.1K

Located in the northern part of Phoenix, ZIP code 85053 is part of the Deer Valley area, a popular residential neighborhood with convenient access to shopping centers, parks, and schools. The gross yield here is 9%, with a healthy annual revenue of $35,002. This area’s family-friendly atmosphere and suburban appeal make it ideal for travelers seeking a quieter environment while being close to major highways that connect them to other parts of Phoenix and nearby cities. The home value of $392.8K makes it an affordable entry point for investors in the short-term rental market.

85034 – Central City/Industrial District

- Gross Yield: 9%

- Annual Revenue: $25,944

- Zillow Home Value: $295.4K

ZIP code 85034 includes parts of Phoenix’s Central City and Industrial District, which is close to downtown Phoenix, the airport, and key transportation hubs. With a gross yield of 9% and an affordable home value of $295.4K, this area provides an accessible investment opportunity with significant potential for short-term rental income. The annual revenue is $25,944, making it appealing for budget-conscious investors. Due to its central location, this ZIP code attracts business travelers and tourists looking for quick access to downtown Phoenix and the city’s cultural attractions.

Top 200 Airbnb Rental Markets

Instantly compare top 200 short-term (Airbnb) rental markets in the US

85032 – Paradise Valley Village

- Gross Yield: 8%

- Annual Revenue: $37,399

- Zillow Home Value: $454.4K

The 85032 ZIP code, part of the Paradise Valley Village area, is known for its upscale homes, shopping centers, and proximity to outdoor activities. This area has a gross yield of 8% and an annual revenue of $37,399, making it a stable choice for investors. While the Zillow home value is on the higher side at $454.4K, the neighborhood’s desirability and appeal to tourists and affluent residents make it a worthwhile investment. Paradise Valley Village attracts travelers looking for a blend of luxury and accessibility, with easy access to the Scottsdale area and top-rated golf courses.

85021 – Sunnyslope/North Mountain

- Gross Yield: 8%

- Annual Revenue: $36,372

- Zillow Home Value: $459.6K

ZIP code 85021 covers the Sunnyslope area and parts of North Mountain, offering a mix of historic charm and modern amenities. Known for its strong sense of community and stunning mountain views, this area is popular among both residents and visitors. With a gross yield of 8% and an annual revenue of $36,372, 85021 provides a balance of solid returns and appreciation potential. Although the Zillow home value is relatively high at $459.6K, the area’s appeal for travelers who enjoy hiking and local eateries makes it a promising investment.

Conclusion

Each of these Phoenix ZIP codes presents unique investment opportunities, from the suburban appeal of Deer Valley to the urban accessibility of Central City. Whether you’re targeting budget-friendly properties or premium markets, Phoenix’s diverse neighborhoods offer lucrative prospects for short-term rental investors.