Introduction

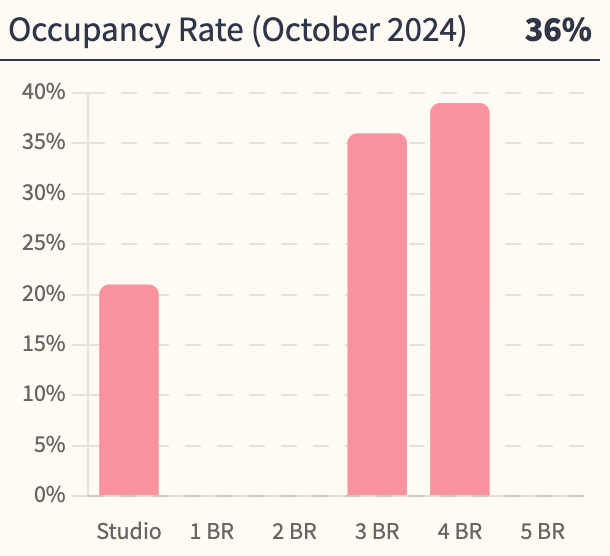

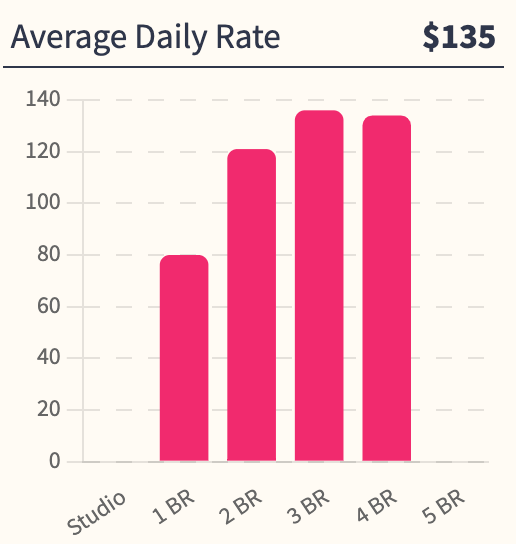

Detroit, MI, known for its rich history, automotive industry, and burgeoning cultural scene, is experiencing a real estate renaissance. The city’s affordability and high gross yields make it an attractive market for short-term rental investments. Let’s explore the top-performing zip codes for investors looking to capitalize on this vibrant city.

48217: Southwest Detroit & River Rouge

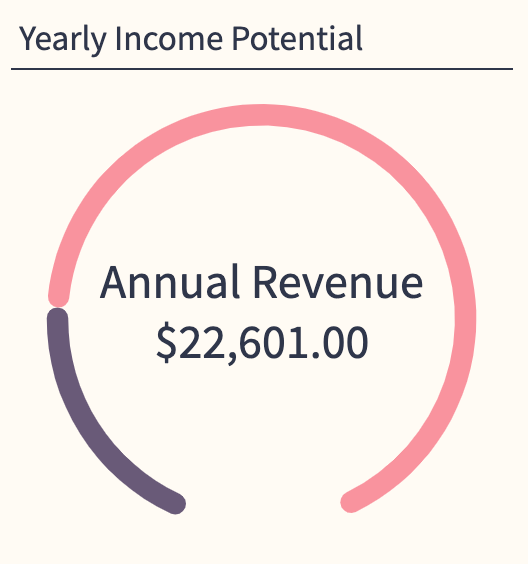

- Gross Yield: 42%

- Annual Revenue: $22,601

- Zillow Home Value: $53.5K

Zip code 48217, located in Southwest Detroit near River Rouge, offers the highest gross yield on this list at a staggering 42%. With an annual revenue of $22,601 and Zillow home values averaging just $53.5K, this area presents a significant opportunity for investors looking for high returns on a relatively low property investment. The neighborhood is close to major industrial hubs, making it appealing for business travelers. Additionally, its proximity to the Detroit River provides unique outdoor experiences for guests.

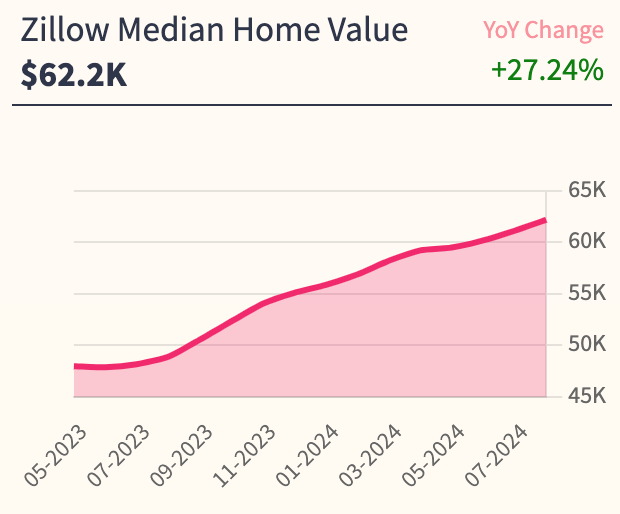

48211: Eastern Market & Hamtramck Border

- Gross Yield: 34%

- Annual Revenue: $21,383

- Zillow Home Value: $62.5K

Zip code 48211 encompasses parts of the Eastern Market district and borders Hamtramck. Known for its vibrant market scene, art installations, and historic warehouses, this area attracts tourists and visitors year-round. The gross yield is an impressive 34%, with an annual revenue of $21,383 and Zillow home values averaging $62.5K. The unique cultural offerings, combined with the area’s ongoing revitalization, make it a prime location for short-term rentals.

48205: Northeast Detroit

- Gross Yield: 31%

- Annual Revenue: $16,631

- Zillow Home Value: $54.1K

Zip code 48205 is located in Northeast Detroit, an area known for its affordability and community-driven redevelopment projects. The gross yield here is 31%, with annual revenue of $16,631 and Zillow home values at $54.1K. While the area is still experiencing challenges, it offers investors a chance to get in early on an affordable market that is gradually improving. With nearby parks and community centers, there is potential to attract guests seeking a more authentic Detroit experience.

Top 200 Airbnb Rental Markets

Instantly compare top 200 short-term (Airbnb) rental markets in the US

48234: Gratiot Avenue Corridor & Surrounding Areas

- Gross Yield: 29%

- Annual Revenue: $15,771

- Zillow Home Value: $54.3K

Zip code 48234 includes the Gratiot Avenue Corridor and surrounding neighborhoods. This area boasts a gross yield of 29% and annual revenue of $15,771, with Zillow home values at $54.3K. The affordable property prices make this an appealing investment area, especially for those looking to benefit from ongoing revitalization efforts. The location offers easy access to downtown Detroit and major highways, drawing travelers who prefer a suburban feel while staying close to urban amenities.

48227: Grandmont-Rosedale & West Detroit

- Gross Yield: 25%

- Annual Revenue: $15,962

- Zillow Home Value: $64.5K

Zip code 48227 covers the Grandmont-Rosedale area and parts of West Detroit. This neighborhood is known for its strong sense of community, historic homes, and well-maintained streets. The gross yield here is 25%, with annual revenue of $15,962 and Zillow home values averaging $64.5K. The area’s ongoing community-led redevelopment efforts have made it more attractive to families and tourists, ensuring a steady stream of rental demand.

Conclusion

Detroit’s real estate market offers exceptional gross yields for short-term rental investors. From the bustling streets of Eastern Market to the community-focused Grandmont-Rosedale, each of these zip codes provides unique opportunities for high returns. As the city continues to evolve, investors can benefit from both short-term rental income and long-term property value appreciation.