Investing in short-term rentals in beach markets is an attractive option for investors looking to generate high returns on their investments. The United States has a vast coastline, making it home to some of the most beautiful beaches globally, and investors can take advantage of this opportunity.

However, with so many beach markets to choose from, it can be challenging to decide where to invest your money. This blog post will highlight the top beach markets to invest in for short-term rentals in the United States in 2023.

Before diving into the best beach markets, it’s worth noting that investing in short-term rentals is a complex process. While data-driven analysis is helpful, it’s essential to remember that actual decision-making is more nuanced.

Factors such as property management, local regulations, and other market conditions can all impact the success of your investment. Therefore, it’s crucial to do your due diligence and consider all aspects of investing in a particular market before making a decision.

Top 200 Airbnb Rental Markets

Instantly compare top 200 short-term (Airbnb) rental markets in the US

Now, let’s explore the top beach markets for investing in short-term rentals in 2023.

1. Fort Walton Beach, FL

Fort Walton Beach, located in the Florida Panhandle, is a charming city with pristine beaches and a thriving real estate market.

According to Zillow, the median home value in Fort Walton Beach is $335,388, with homes appreciating by 5.40%. This indicates a strong real estate market in the city, making it an excellent option for investing in short-term rentals.

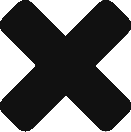

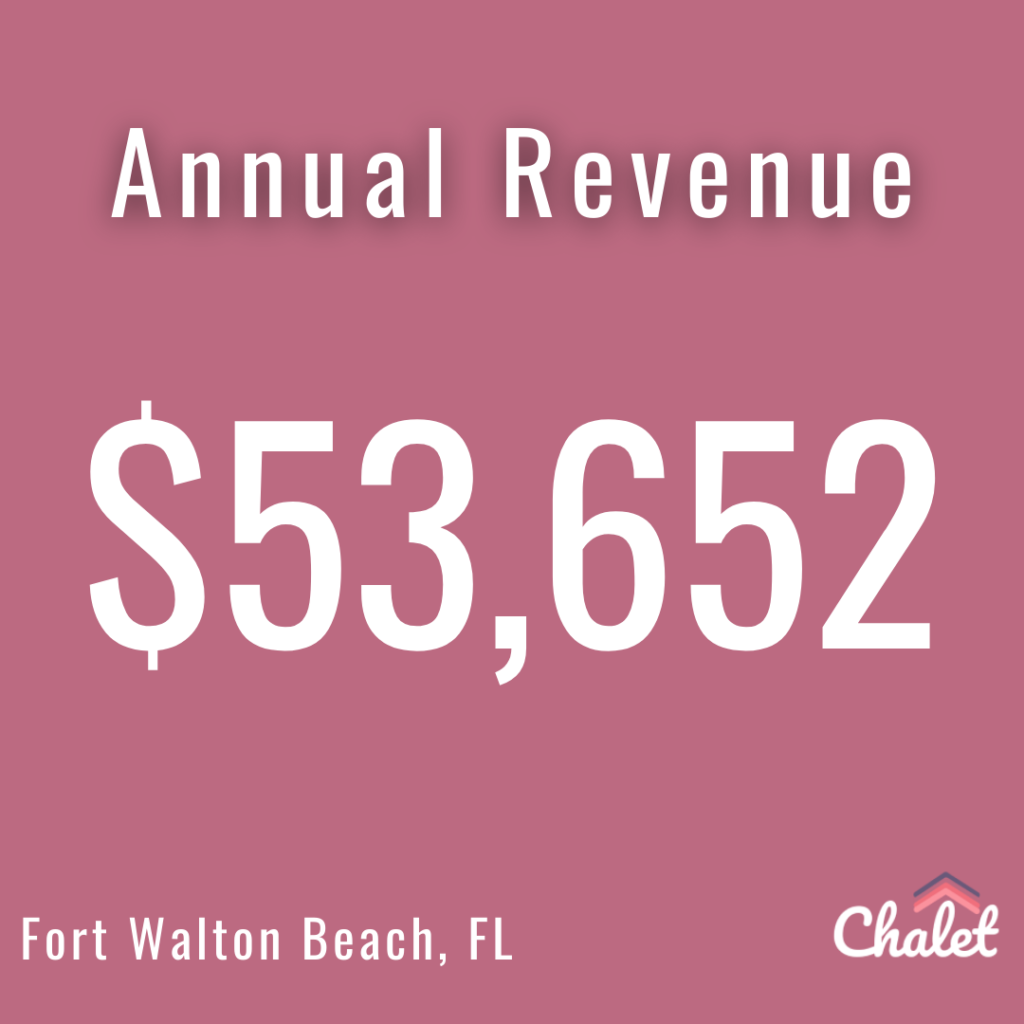

There are currently 2,850 active short-term rentals in Fort Walton Beach, with an average daily rate of $299 and an occupancy rate of 74%, according to Chalet. The annual revenue generated by short-term rentals in the city is $53,652, with an average gross yield of 16%.

Check out our Fort Walton Beach Airbnb Investor Guide for a deeper dive into our analysis of this short-term rental market.

2. Pensacola, FL

Located on the western tip of Florida’s Panhandle, Pensacola is known for its sugar-white beaches and crystal-clear waters. The real estate market in Pensacola is thriving, with homes appreciating by 7.90% over the past year, and a median home value of $247,364, according to Zillow.

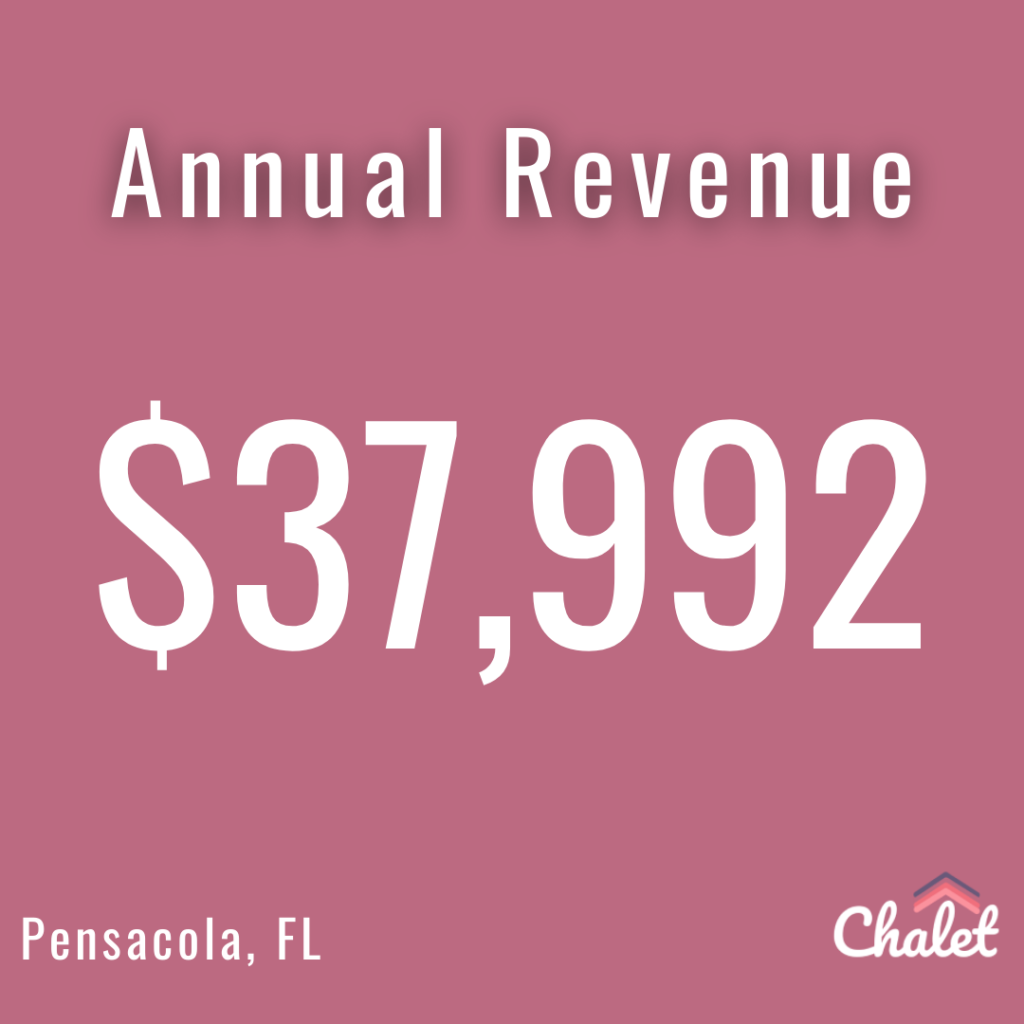

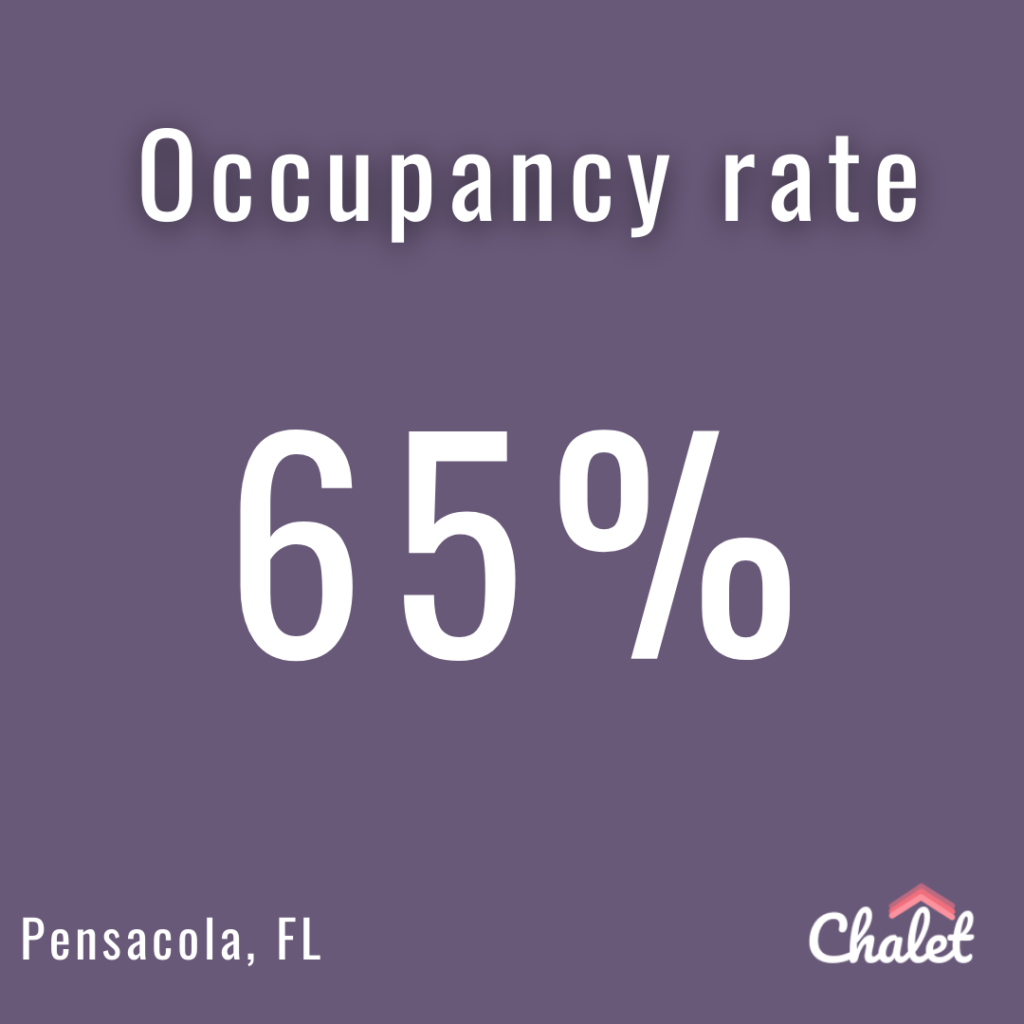

Chalet reports that there are currently 3,855 active short-term rentals in Pensacola, with an average daily rate of $240 and an occupancy rate of 65%. This translates to an annual revenue of $37,992 for short-term rental properties in Pensacola. The average gross yield for short-term rental properties in Pensacola is 15.36%, making it a strong return on investment for property owners.

Check out our Pensacola Airbnb Investor Guide for a deeper dive into our analysis of this short-term rental market.

3. Fort Myers, FL

Fort Myers is a beautiful coastal city located in southwestern Florida. According to Zillow, the median home value in Fort Myers is $364,249, with homes appreciating by 7.60% over the last year. This indicates a thriving real estate market in the area, making it an attractive option for investing in short-term rentals.

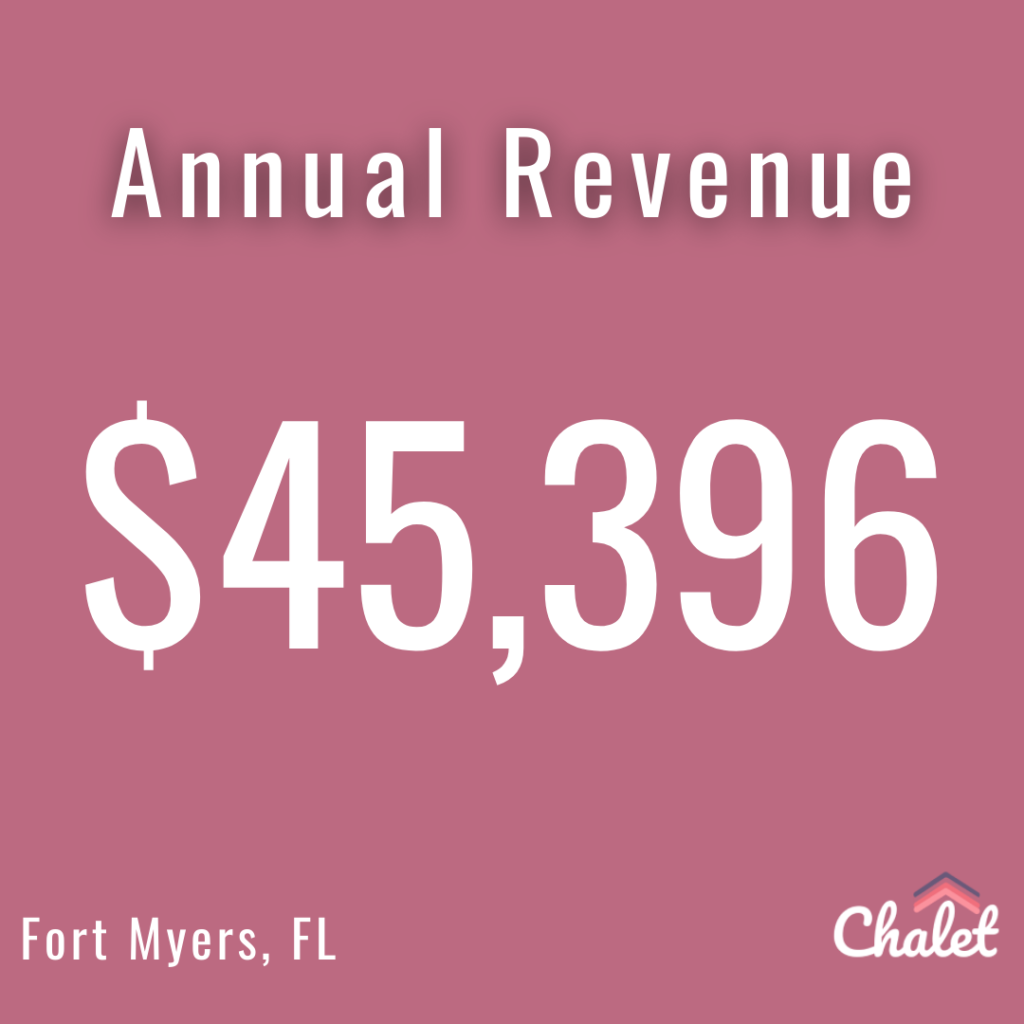

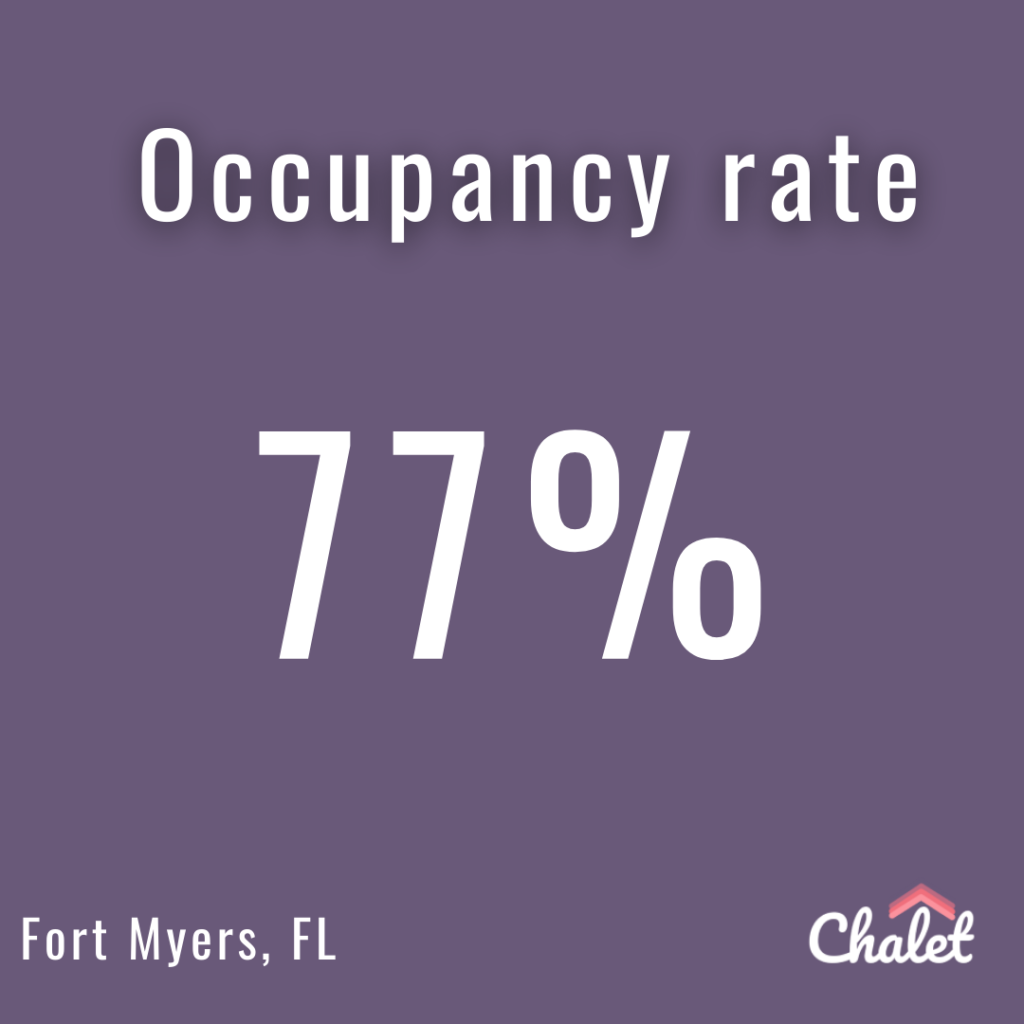

Chalet reports that there are currently 2,232 active short-term rentals in Fort Myers, with an average daily rate of $283 and an occupancy rate of 77%. This means that short-term rental investors in Fort Myers see significant returns, with an annual revenue of $45,396.

Check out our Fort Myers Airbnb Investor Guide for a deeper dive into our analysis of this short-term rental market.

4. Gulf Shores, AL

Gulf Shores is a popular vacation destination located on the Gulf of Mexico in southern Alabama. According to Zillow, homes in Gulf Shores appreciated 3.30% in the last year, with a median home value of $444,535. This rapid appreciation is driven, in part, by the growing demand for vacation rentals in the area.

Chalet reports that there are currently 6,955 active short-term rentals in Gulf Shores, with an average daily rate of $288 and an occupancy rate of 67%. The annual revenue for short-term rentals in Gulf Shores is $53,148.

Check out our Gulf Shores Airbnb Investor Guide for a deeper dive into our analysis of this short-term rental market.

5. Virginia Beach, VA

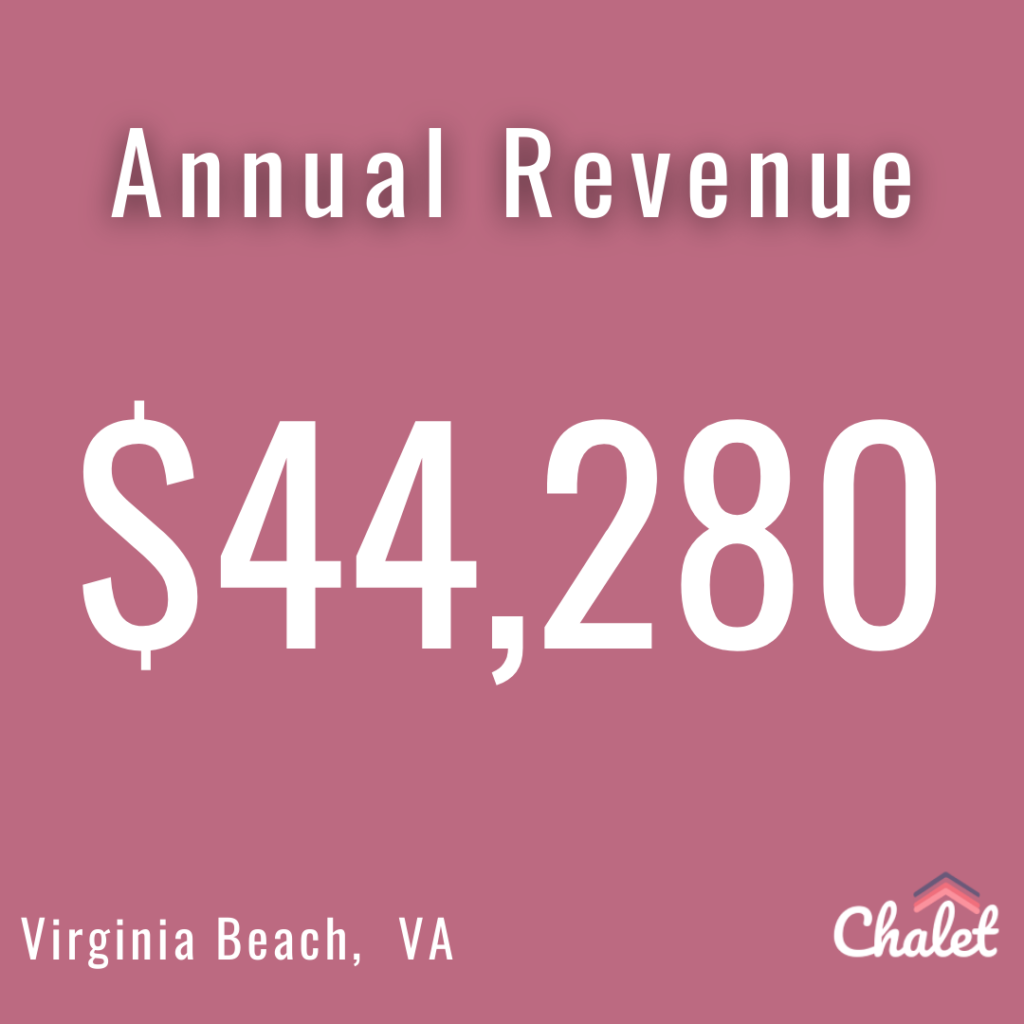

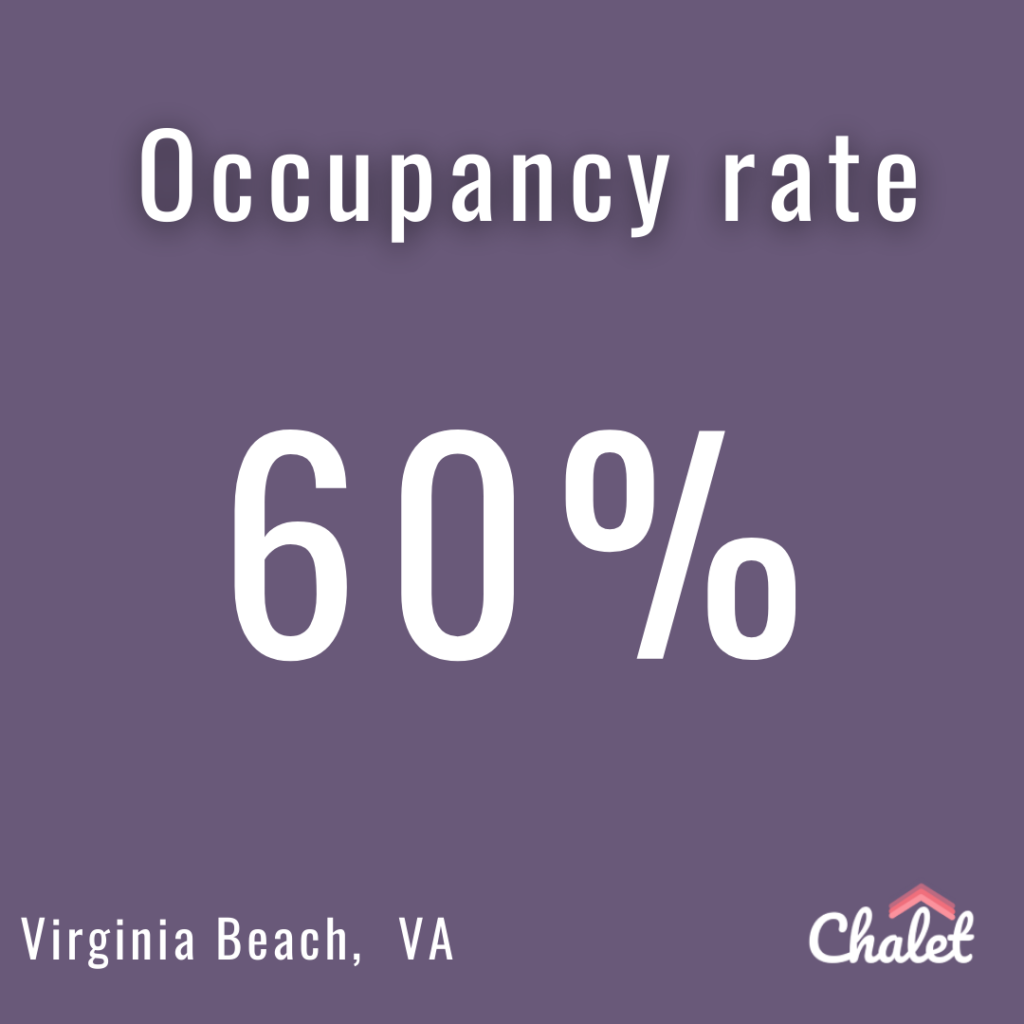

According to data from Chalet, there are currently 2184 active short-term rentals in Virginia Beach. The average daily rate for these rentals is $312, and the occupancy rate is 60%.

The real estate market in Virginia Beach is also growing, with homes appreciating 3.00% according to Zillow. The median home value in Virginia Beach is $370,922.

These statistics indicate that short-term rentals are in high demand in Virginia Beach, with visitors willing to pay premium prices for the convenience and amenities that short-term rentals offer. T

The annual revenue for short-term rentals in Virginia Beach is $44,280, which is a significant amount for property owners who use their homes as short-term rentals.

Furthermore, the average gross yield for these rentals is 11.94%, which is an attractive return for investors.

Check out our Virginia Beach Airbnb Investor Guide for a deeper dive into our analysis of this short-term rental market.

6. Cape Coral, FL

According to Chalet, a leading provider of data and analytics for the short-term rental industry, there are currently 5207 active short-term rentals in Cape Coral. This number has increased by 21% when compared to Q4 of 2021, indicating a growing interest in the city’s short-term rental market.

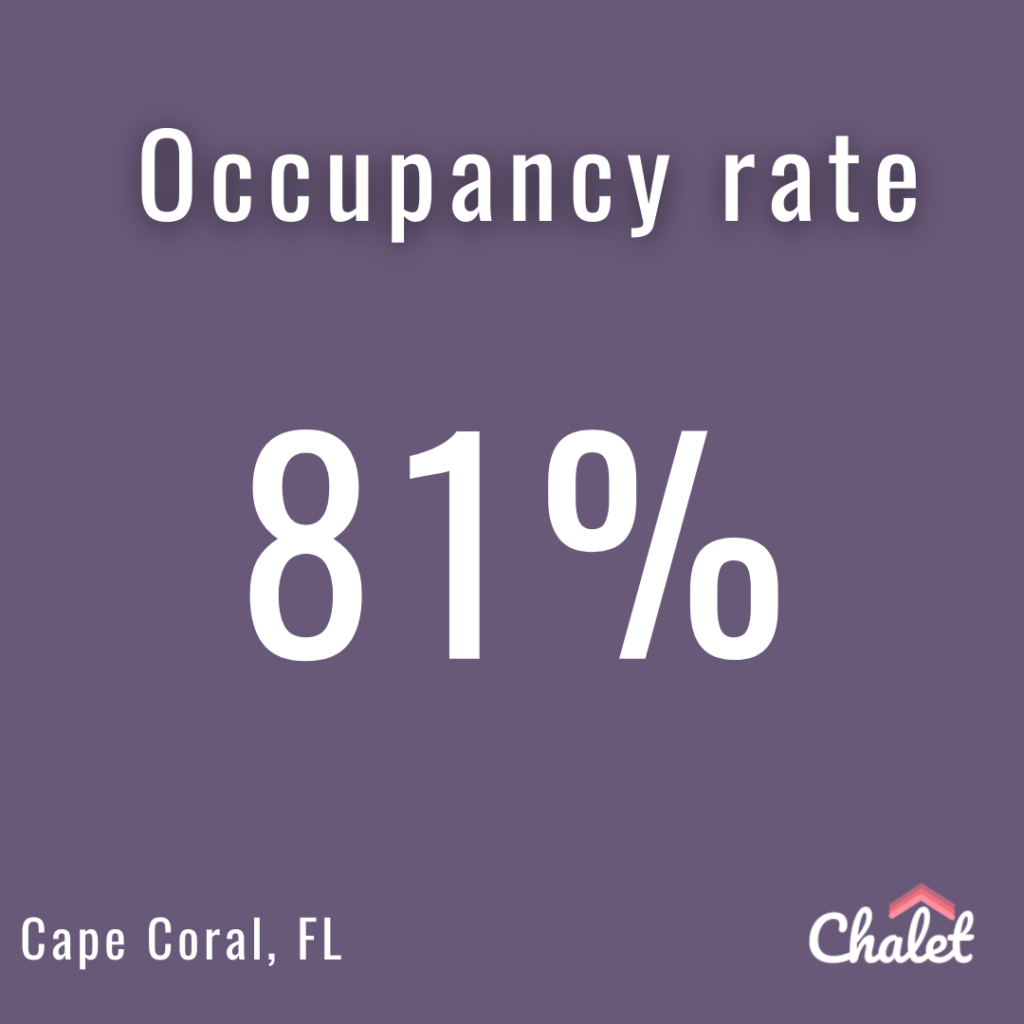

The average daily rate for short-term rentals in Cape Coral is $289, with an occupancy rate of 81%.

According to Zillow, a real estate website that provides data on property values and trends, the median home value in Cape Coral is $379,738.

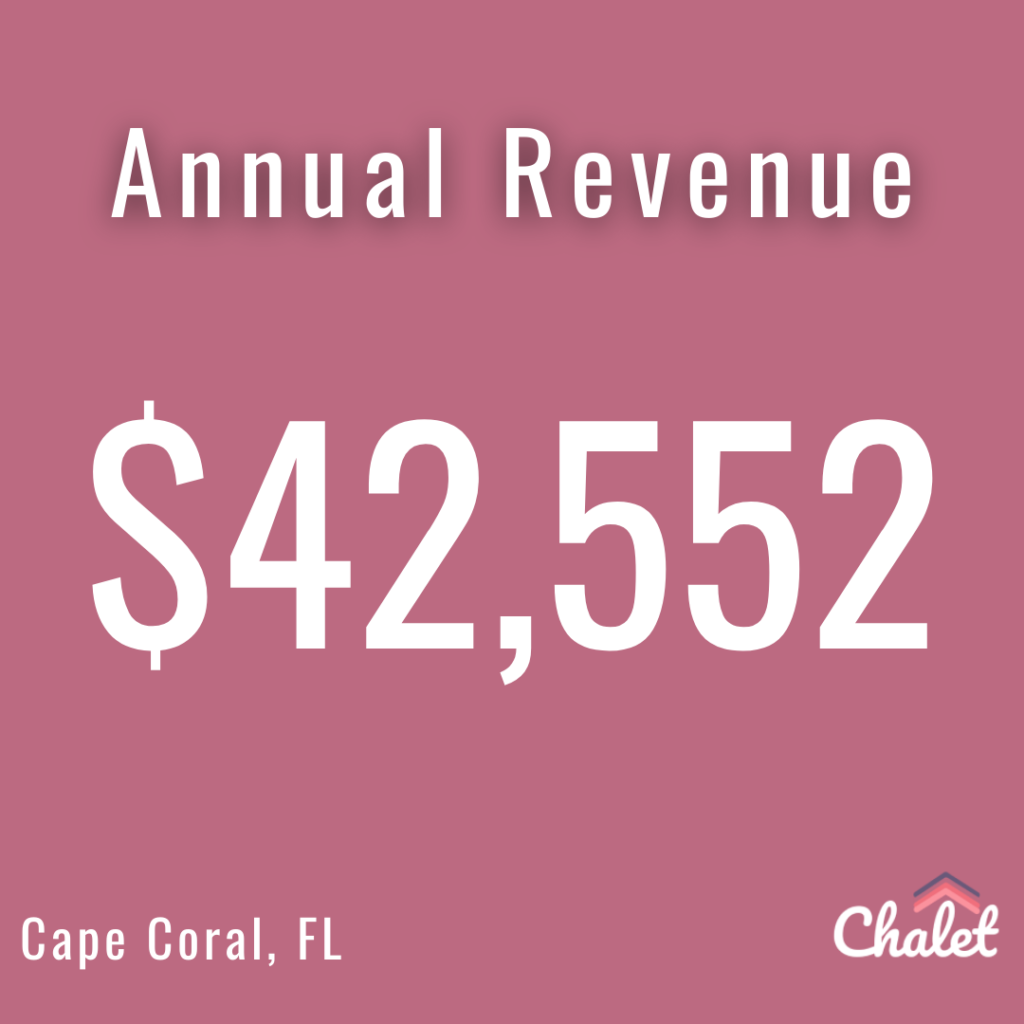

This means that on average, short-term rental properties in Cape Coral are occupied for 81% of the year. Chalet also reports that the annual revenue for short-term rentals in Cape Coral is $42,552, with an average gross yield of 11.21%.

Check out our Cape Coral Airbnb Investor Guide for a deeper dive into our analysis of this short-term rental market.

7. Pompano Beach, FL

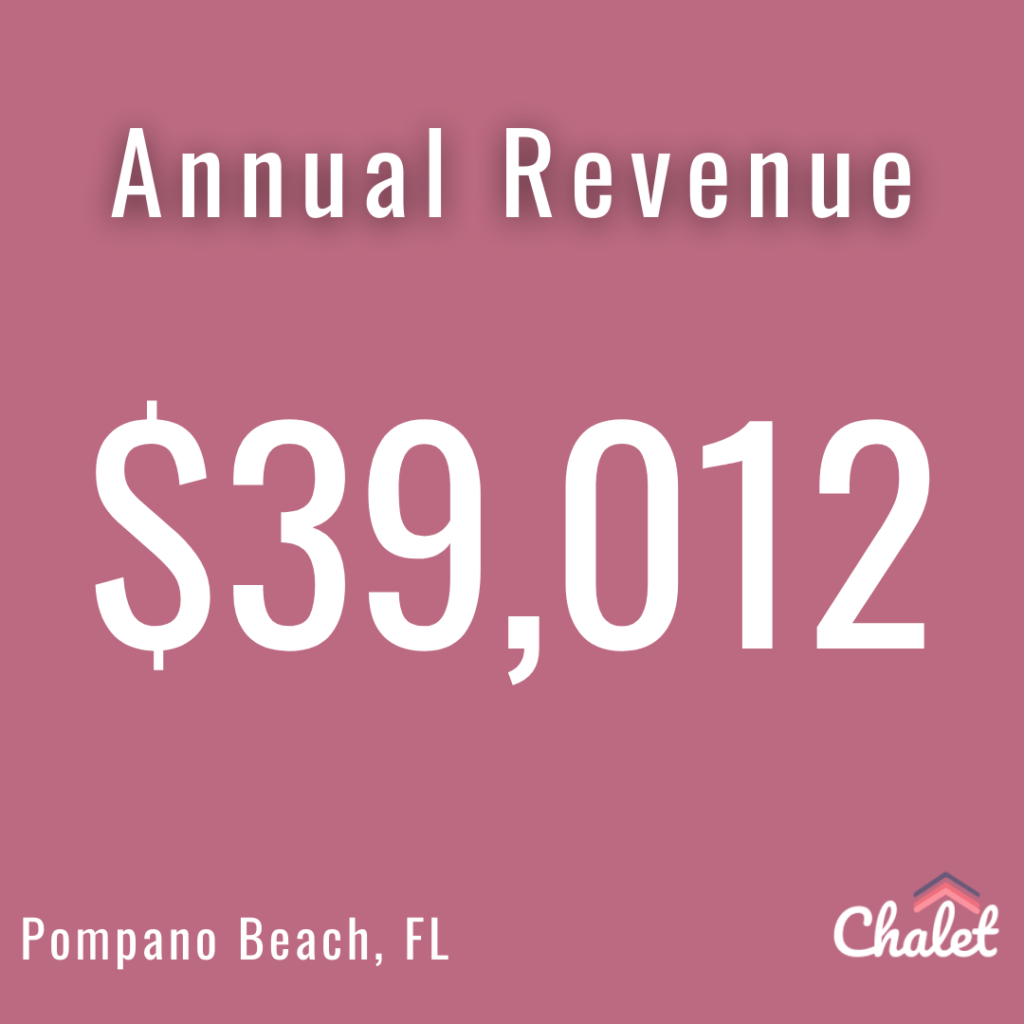

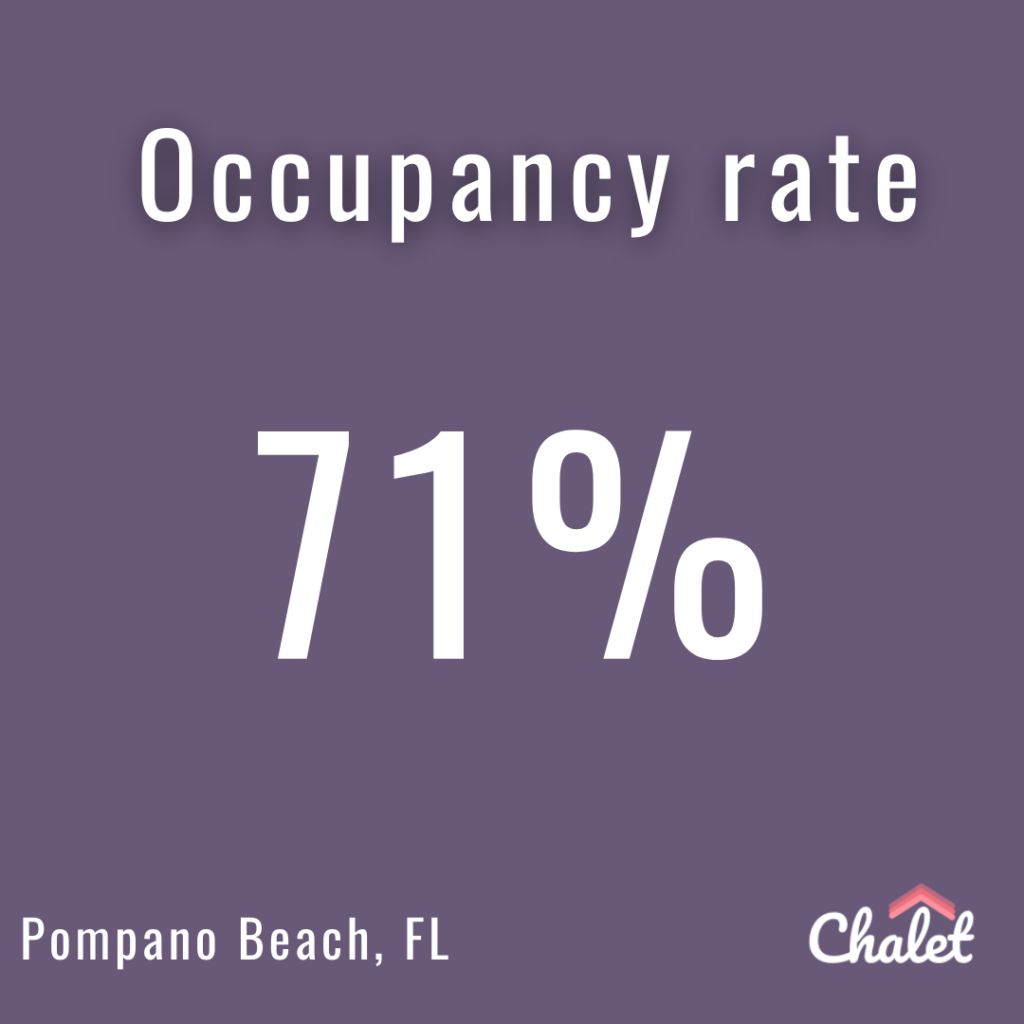

The performance of the short-term rental market in Pompano Beach, FL is impressive. According to Chalet, the average daily rate for short-term rentals in the city is $237. The occupancy rate is also healthy, standing at 71%. This has resulted in an average annual revenue of $39,012 for short-term rentals in Pompano Beach, FL.

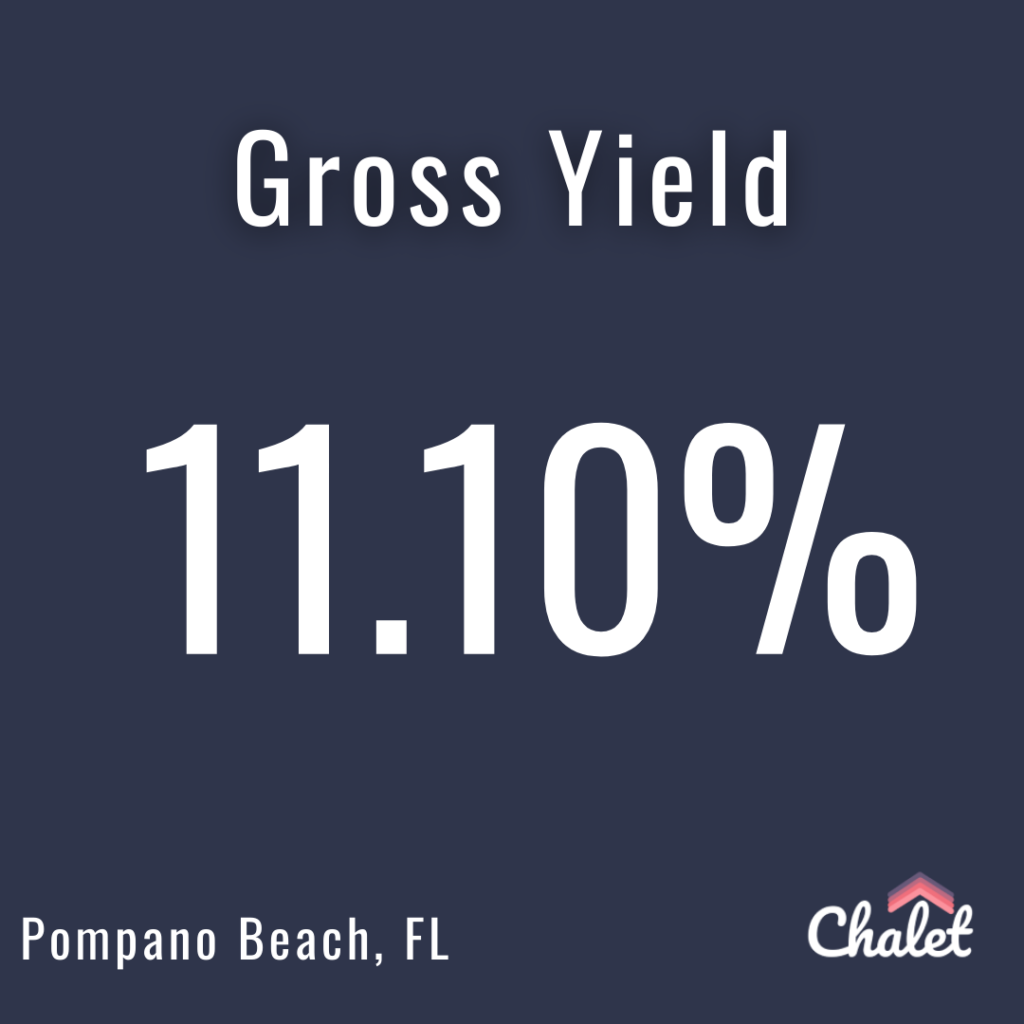

The gross yield for short-term rentals in Pompano Beach, FL is also high, standing at an average of 11.10%. This performance reflects the strong demand for short-term rentals in the city.

Investors are attracted to Pompano Beach’s median home value, which according to Zillow, is $351,432.

Check out our Pompano Beach Airbnb Investor Guide for a deeper dive into our analysis of this short-term rental market.

8. Myrtle Beach, SC

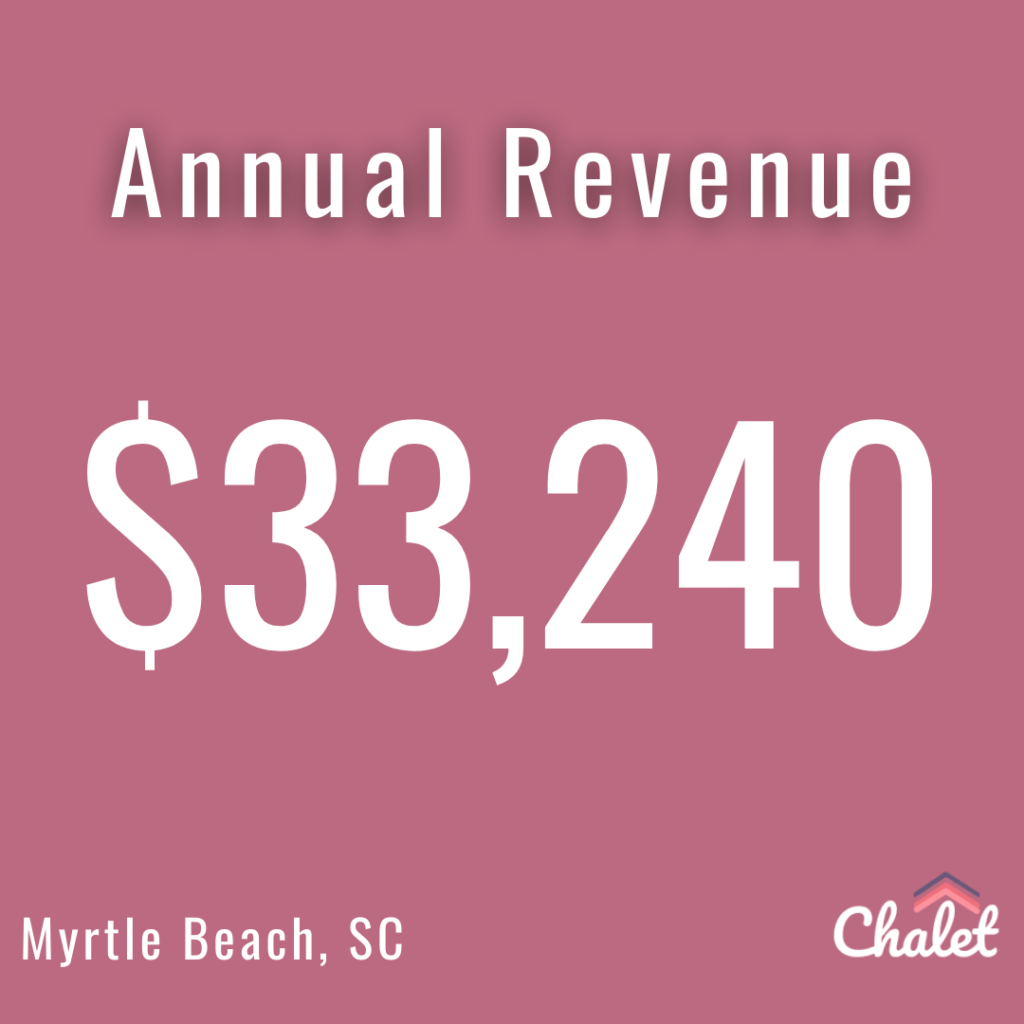

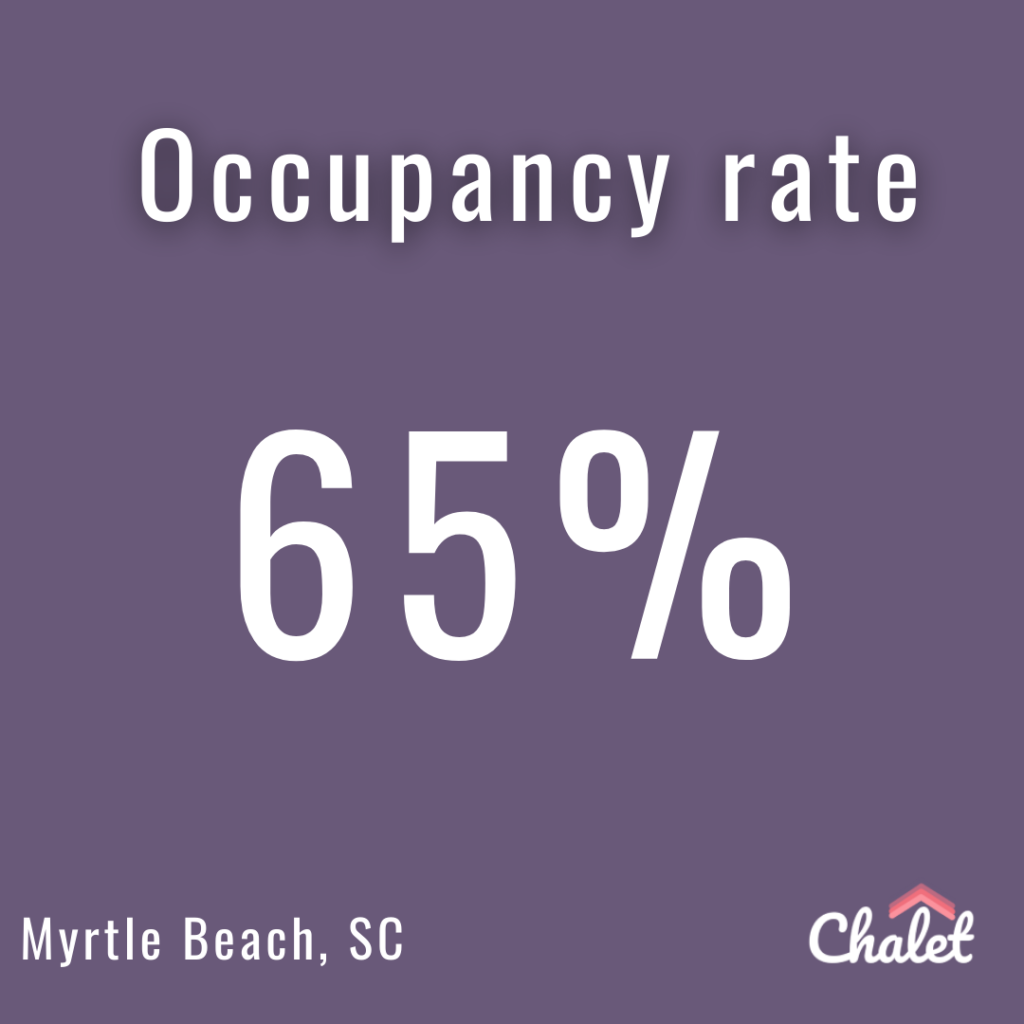

Chalet reports that there are currently 11,021 active short-term rentals in Myrtle Beach, with an average daily rate of $199 and an occupancy rate of 65%.

The annual revenue for short-term rentals in Myrtle Beach is $33,240, and there has been a 12% increase in supply compared to Q1 of 2022. The average gross yield is 11.01%, which is attractive for investors seeking high returns.

According to Zillow, homes in Myrtle Beach have appreciated by 9.7% over the past year, making it a strong market for real estate investors. The median home value is $301,846, which is slightly higher than the national average.

Additionally, the average property tax is 0.42%, which is relatively low compared to other states.

Check out our Myrtle Beach Airbnb Investor Guide for a deeper dive into our analysis of this short-term rental market.

9. Galveston, TX

The average daily rate for these rentals is $277, and the occupancy rate is 48%. As a result, the annual revenue for a short-term rental in Galveston is $38,136, making it a potentially lucrative investment.

According to Zillow, homes in Galveston appreciated by 8.20% over the past year, which is a significant increase. The median home value in Galveston is currently $347,352, which is lower than the national median home value.

Investors looking to enter the Galveston short-term rental market may be interested in the average gross yield and property tax. The average gross yield in Galveston is 10.98%, which is competitive with other vacation destinations.

The average property tax in Galveston is 1.92%, which is relatively low compared to other cities and counties in Texas.

Check out our Galveston Airbnb Investor Guide for a deeper dive into our analysis of this short-term rental market.

Conclusion

While these figures are certainly encouraging, it’s important to approach investment decisions with caution and not solely rely on numbers.

Other factors such as location, property condition, local regulations, and competition should also be considered. It’s essential to conduct thorough research and due diligence before investing in any short-term rental property.

In conclusion, the above-listed beach markets in the United States offer promising opportunities for short-term rental investments as of April 2023.

Fort Walton Beach, Pensacola, Fort Myers, Gulf Shores, Virginia Beach, Cape Coral, Pompano Beach, and Myrtle Beach are all markets with strong real estate markets and high demand for vacation rentals.

With careful consideration and due diligence, investors can take advantage of these lucrative short-term rental markets in the United States.